Many proprietors of unlimited companies think that it is very easy to file tax returns for unlimited companies. They do not need to prepare financial statements, let alone find an accountant to prepare audit reports. Therefore, bosses often handle it by themselves or find someone who has basic accounting knowledge. Yet, if you continue doing the same thing, be aware that you may be fined a large sum of money by the Inland Revenue Department. Want to avoid unnecessary fines? We will dismantle the misunderstandings of tax filings by unlimited companies one by one in this article.

Didn’t receive a tax return for your sole proprietorship business?

“I am operating a sole proprietorship business, and it seems that I have not received an independent corporate tax return, so I do not need to declare the income of the sole proprietorship business.”

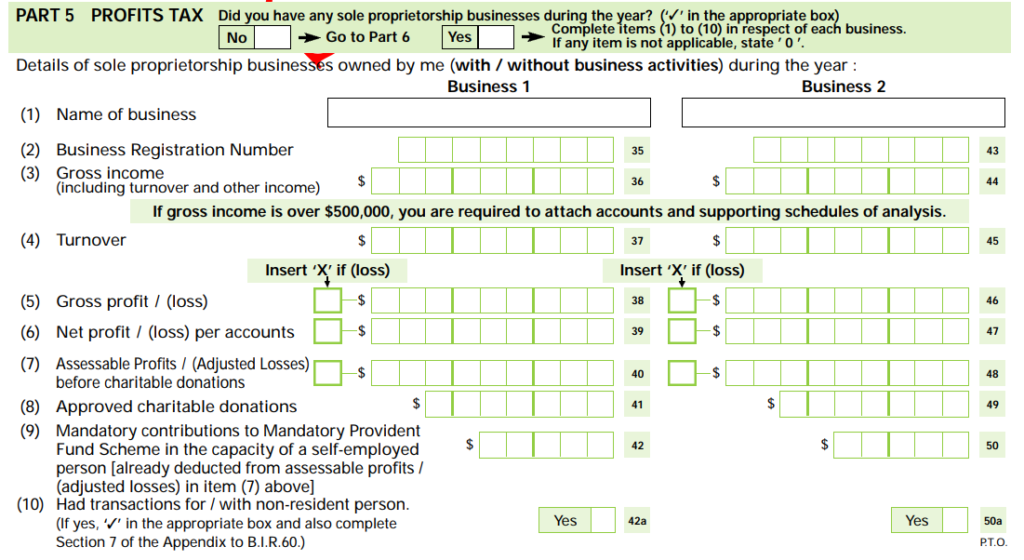

Sole proprietorship business uses the fifth section of the personal and sole proprietorship tax return (BIR60) when filing tax returns. This tax return is also used when filling in the salaries tax return, so tax returns for sole proprietorship businesses still have to be filled in.

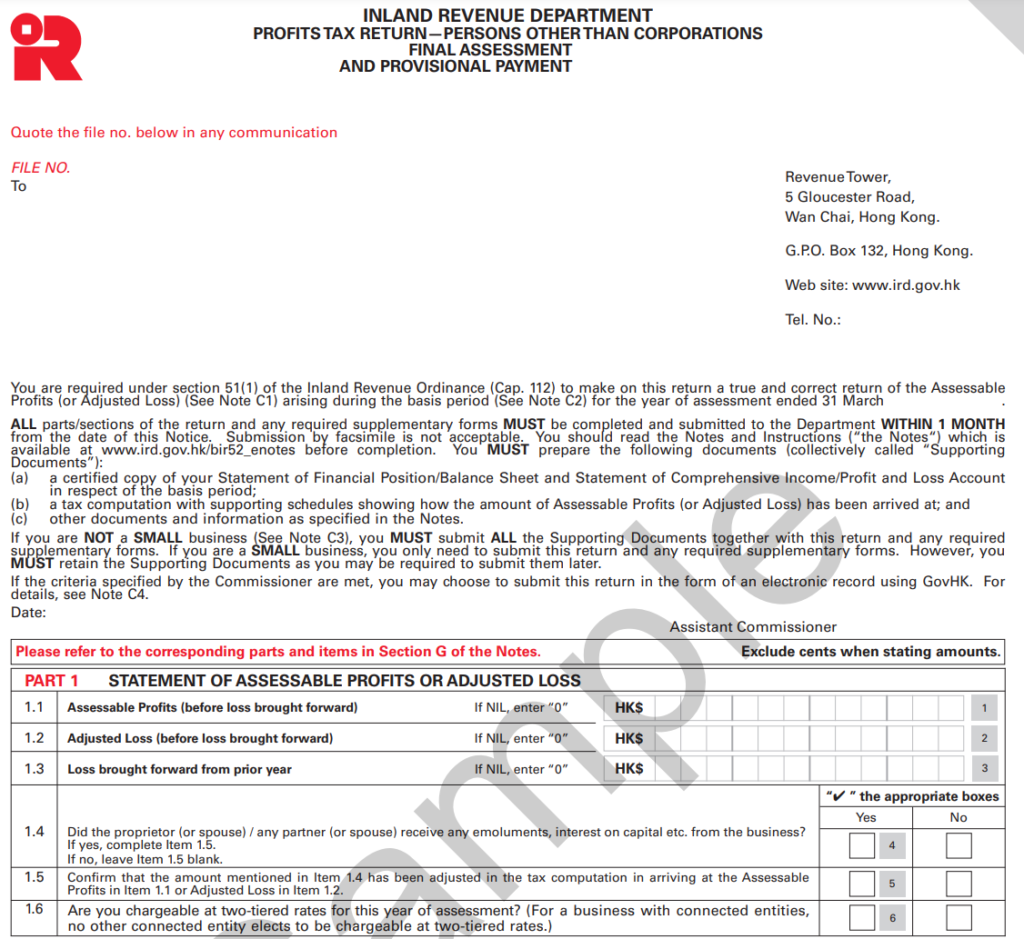

In addition, if you are running a partnership business, you will receive a separate tax return form – Persons Other Than Corporations (BIR52). The different tax return forms are the only difference between partnership and sole proprietor businesses in terms of taxation.

Unlimited companies do not need to prepare accounts?

Unlimited companies do not need to submit their accounts when submitting tax returns, and there is no other law that requires unlimited companies to submit financial statements or business accounts, so they generally do not need to submit company accounts.

In Hong Kong’s current laws, there is no requirement to hire an accountant for preparing financial statements or business accounts when operating as an unlimited company. Yet, under the Inland Revenue Ordinance, regardless of the company type, company accounts must be kept for at least 7 years, so even if you operate as an unlimited company, you will still need to have company accounts.

In addition to keeping relevant records for at least 7 years, the IRD may also require unlimited companies to submit accounts. When a company’s total business income exceeds HK$2 million or more, the IRD will require that unlimited company to submit their account together with their tax return. For companies with total operating income expected to be less than HK$2 million, although the IRD does not require unlimited companies to submit their accounts together with their tax returns, the tax assessor can still request the company to provide it at any time, so the company should still prepare company accounts every year.

Can the proprietor’s wages provide tax deductions for unlimited companies?

The wages earned by the proprietor is taxed through salaries tax, while the profit of unlimited companies is taxed through profits tax. The two taxes are different. The more wages an unlimited company pays to the proprietor, the less profits tax paid by the company .

According to Article 17 of the Inland Revenue Ordinance, any salary paid to the proprietor or his spouse, partner or partner’s spouse is a non-deductible expense. No matter how much a company pays the proprietor, it will still be counted in a tax calculation table.

Except for the proprietor’s wages, if the proprietor or his spouse, partner or partner’s spouse borrows money from the company, then the company has incurred interest expenses. Regardless of whether the relevant loans and interest are reasonable or not, they are all non-deductible expenses under Article 17 of the Inland Revenue Ordinance.

If household and private expenses are recorded in an unlimited company, can tax be deducted?

“The accounts of an unlimited company do not need to be audited by an accountant. I can keep the daily expenses of myself and my family in the unlimited company so that the company can pay less tax.”

According to the Inland Revenue Ordinance, all expenditures and expenses incurred in any period of profit that are taxable under this part can be deducted. In other words, the related expenditures must be related to the company’s business. Only expenses that generate profits can be deducted. Therefore, since household and private expenses cannot bring profits to the company, the related expenses cannot be deducted in the tax assessment.

In addition, although the accounts of unlimited companies do not need to be audited by accountants, the tax assessor of the Inland Revenue Department will review the company’s accounts more carefully. For example, they will compare the company’s past data and infer whether the reported expenses are reasonable based on the company’s industry, so as to make a preliminary judgment, before deciding whether to ask for more documents.

Can two unlimited companies share profits and pay less tax?

According to the two-tiered profits tax, a company can enjoy a tax rate of 7.25% for the first HKD2 million. Therefore, some proprietors may plan to use the two-tiered profits tax for two sole proprietorship businesses to achieve the purpose of tax deduction.

But in fact, the tax bureau considers sole proprietorship businesses with the basis of a person as a unit, so no matter how many sole proprietorship businesses there are, only one can enjoy the tax rate of 7.25%, while other sole proprietorship businesses will be subject to the original tax rate of 15%.

Pacers is a company that provides multifaceted and professional consulting services. We are eager to grow with our clients, so if you encounter any issues on taxation, you’re welcome to contact us through our website or email at info@pacersconsulting.com.

Want to learn more about real-life examples in taxation? Follow us on Facebook, Instagram, and Google now to stay on top of our latest news!

0 Comments